2021 is the year of turmoil, downfalls, miseries, and sudden changes due to the proximity of the Covid mutation. At some point, it felt that the world was going to pause. But some people like students, patients, and businesses, had to pay their loans, finances, and other medical debt to stay afloat. Do you want to relieve the stress of these people? All of this points towards the loan lending app development services right now. Loan lending apps are the big solution to rescue this situation and to restrict people to face and wait in long queues for loan approvals.

Recently, several companies have come together to solve these hindrances, developing mobile applications to borrow instant money services for the people. Mobile Applications are facilitated with high-edged options to check out instant eligibility and the current status for the loan approvals. This article covered all of the essentials required of you while developing the loan lending app in 2021. We have covered below all of the major sections including, brief knowledge of a loan lending app, its market presence, types of loans, top market leaders, the benefit for borrowers and lenders, important development models, quintessential features, cost estimation, and the team structure, to develop your loan lending mobile app.

So, let’s get started!

Introduction

Starting a new business is a challenging task due to the presence of cut-throat competition in the business world. Funds and budget are other major elements that play a decisive role in starting a new venture. But with the availability of loans, the stress can be eased out to a great limit. Gone are the days when people had to visit the bank for financial requirements. Now things have gone digital and facilities can be arranged with a tap. The loan lending app is becoming increasingly popular in the business. A glance into the same will give you a better understanding of the concept which has taken the business world by storm.

Peer-to-Peer lending is known as P2P lending, is a service that brings money lenders and borrowers together through an online medium. In short, it connects money lenders with money borrowers. It is direct communication between the moneylender and the borrower without the intervention of a financial organization or institution like a bank. Such websites have come forth as a great alternative to banking and other financial facility providers. It is conveniently termed as a Loan Lending App.

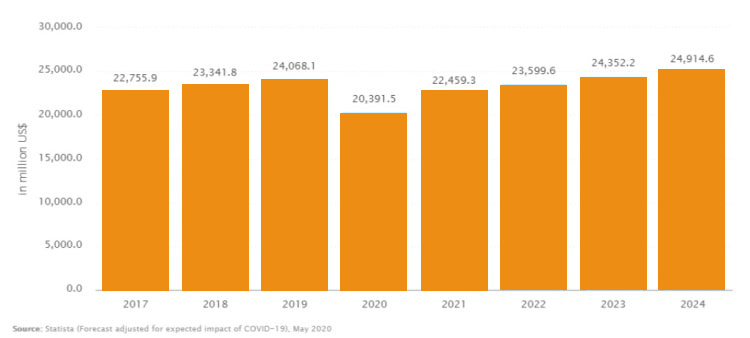

Market & Growth Stats

- The global digital market of lending platforms is projected to reach $12.118 Billion with a CAGR of 18.7% by the year 2023.

- The global P2P (peer-to-peer) market is growing at the CAGR of 29.7% to reach $558.91B by 2027.

- The total revenue costs in the alternative lending segment are estimated to reach $306.1M in 2021 and are expected to reach $382.5M by the year 2025 with a growth rate of 5.73%.

- In the Singapore market, the topmost segment for loan lending is Crowdlending whose annual revenue is $291.4M in the year 2021.

The above stats surely indicate that the market of loan lending application development is booming throughout an outbreak to reduce the rate of interest and boost the returns of the lenders. It aims to provide a quick and convenient loan method on the online platform.

Lesser market risk and reduced operational cost for both borrowers and lenders show the major significance for the spontaneous growth of the lending loan market. Especially in the countries like Singapore, the USA, UK, Italy, India, etc., the rise in the small business segment would garner an efficient share during the forecast year.

Depending upon the requirement of the businesses, various models have been attributed to consumer lending and business lending. Whereas the loan sanction is segregated into small business loans, credit loans, and real estate loans which is further bifurcated into personal loans, home loans, vehicle loans, student loans, and business loans. The key players in the market are Avant Inc., Kabbage Inc., Prosper Marketplace, LendingTree LLC, etc.

What parameters users are looking for in a loan lending app?

The need for simplicity is paramount. Same in the case of the loan lending mobile app development. If you are looking to develop a mobile app that is able to do the task quickly, then you need to deploy the essential process and understand some of the important parameters before saving your research time. These parameters will help you more.

1. Accountability

If you are the owner of the loan lending service company, or you are one of the solopreneurs who doesn’t have the idea of how to start their services in the market, then you must prepare yourself to cater services to your users. To catch a large number of customers from the marketplace, you must be well aware of the intrinsic pros and cons of the loan lending services or must hire an established firm.

Read Also: Real-Estate Mobile App Development: Cost & Key Features

2. Service

People are more captivating towards those firms which are more customer-oriented. Make sure to treat them well obliged with your services. If your mobile app’s services are highly customer-centric and you choose to offer them with best services then, chances are they feel trusted to go for the loan sanction. Your app with customer assistance integration serves them instantly and makes them feel good.

3. Speed

Faster speed is one of the crucial factors for the loan lending app to online loan applicants. For faster speed and secured payments, it is advisable to tie up with the best options of the mortgage companies that offer quick and secured loan sanctioning.

4. Process

People are leaning towards money lending app development because they are assured of the services, responsiveness, and reliability of these apps. The apps are a resource with an easy ongoing process to offer prominent services to the users. That will in the long term increase your capital, productivity, and trust. Infuse some of the advanced options inside the app for easy hand on calculations like estimating the rate of interest using the calculator and others for the fast service process of the app.

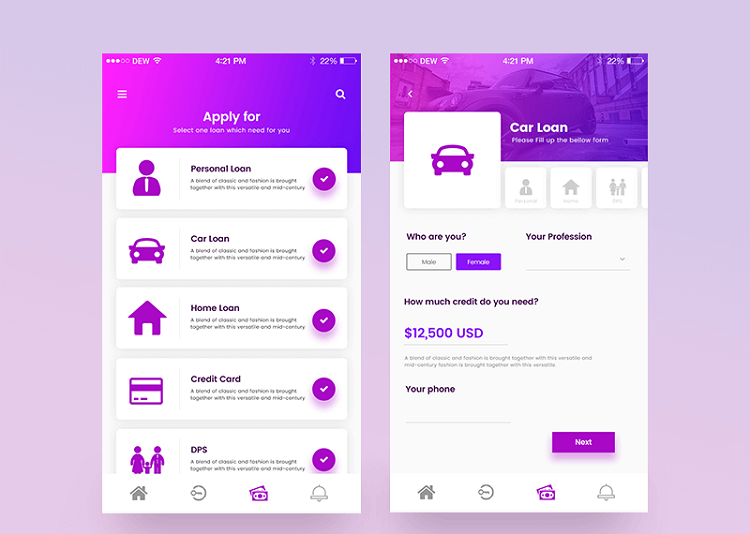

Types of Loan Lending Mobile Applications

The market is composed of different categories of apps for borrowers to facilitate lenders for taking the loans as per the choice, budget, popularity of the niche, and other uncertain factors. Owners can go for the development of the different lending apps as per their financial stability. Let’s have a look at some of the mobile apps.

- Student loans

- Personal loans

- Startup or small business loans

- Mortgages or home loans

- Car loans

Based on the lender’s other options have provided loan entities via the use of apps. Some of them are as follows:

- Peer to peer (P2P) app

- Banks and other financial institutions

- Credit union banks

The last category of mobile apps is categorized according to the technology stack. Some of the latest technologies are as follows:

- Chatbots

- Artificial intelligence (AI)

- Machine learning

- Chatbots

- Bitcoins

- Big data

- IoT (Internet of things)

How do Loan Lending Apps work?

The applications that offered such services have to set rates of interest and terms/conditions of the facility. Most of them offering such services have a wide and diverse range of interests that are offered to the users based on their credit score.

- The borrower can create an account in such a site by depositing some money which can be dispersed as a loan.

- The loan seeker will post the requirement and assign the willing rate of interest he/she is determined to pay instead of the loan.

- Offers can be reviewed by the applicant subsequently allowing him/her to accept the offer.

- The money is transferred to their account and monthly payment can be handled through the website.

Benefit of Loan Lending Apps

Money lending apps are eliciting to the marketplace, stakeholders, borrowers, and lenders. People are now more reliable in taking loans using the mobile lending app platforms for some of the purposes. First is they have found it more secure, more responsive, and trustworthy. People get to know all of the details at their place without any cause of pitfall. There are many reasons, so below let’s understand some of the common benefits for the borrowers and the money lenders using this app.

The terms and conditions are set by both the parties (borrowers and seekers): Factors like rate of interest, monthly payment, and deadline are easily decided by the borrower and the loan seeker. They can decide the terms which are acceptable to both parties. However, the applicant cannot apply for a new loan until the previous one has been paid off. The borrower can fill several points as clauses that the borrower needs to abide by.

Rate of Interest is minimal: As the services offered are through an online platform, the overhead costs of running a financial institution are absent. Thus the carrier can offer a low rate of interest on the loan which acts as a catalyst in attracting the attention of loan seekers.

Benefits for Borrowers

- Easy way to get a loan: The procedure adopted by these mobile platforms is easy, and convenient. Simply you just need to search for a suitable money lender and fill your details inside the form, and that’s it. Next, the lender will progress to choose or discard the request.

- Offers low-interest rate: Banks are more interested in people who have a past good credit history. They could offer them a low interest rate and offer more convenient plans for them. Easy way procedure: The process to request the loans is easy. Reviews and ratings are displayed to the user to make sure about the app.

- Safety: All the transactions are encrypted and protected to restrict any loopholes.

- Loan varieties: Various types of loans are available including home loans, vehicle loans, personal loans, and others for the people to choose as per their choice of interest.

- It is not an expensive affair: The fact that such services are offered through a financial institution mean shelling out a huge sum of money as fees deter applicants from approaching the banks. Through the online carrier, the same process is processed at minimal fees, and the need for physical presence is also eliminated. The entire process is online and hence the convenience quotient is very high. The applicant can avail of the facility sitting at the comfort of their home or workplace. No deposits or guarantors are required to undergo the procedure.

- Inspection of the applicant is important: The borrower should be sure about the applicant’s status. Hence the applicant should upload documents and scanned copies of IDs like passport, tax identification number, etc. so that credibility can be attached to the application. They even need to provide their income status which will act as an important decisive factor for the borrower to accept the application for the loan. The credit score of the applicant will be inspected and based on the credit report, the lender can make a decision.

Benefits to the money lenders

Now let’s check out some of the benefits relatable to the money lenders.

Less operational costs: There is no extra space required for handling the operations of the money lending. So the cost for this has been minimized.

Fast KYC process: The applications come up with the pre-scanning of the documents required for the process of taking the loans, so the borrowers need not carry these important documents with them.

Obtain a large customer base: Apps are highly approachable by the customers compared to the offline and they get to connect with them more instantly.

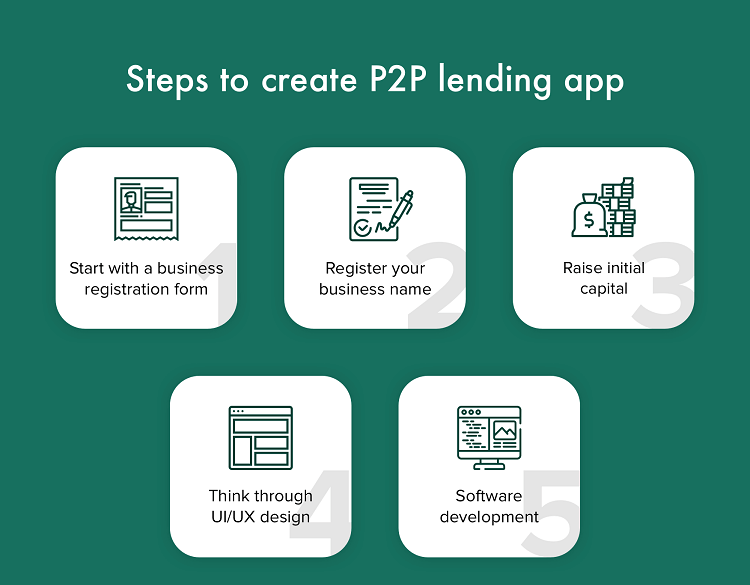

Development Models

After gaining the in-depth knowledge of the loan lending services the next thing you need to focus is on the deployment process. Many of the business plans have failed due to the shortage of inefficient procedures. Right loan lending mobile app developers and their model helps your process of making the app from the beginning to the end.

Product development: In this development part, the team for development will provide full access to the product development from the planning, to coding, designing, testing, releasing, and other ongoing requirements for the product.

Dedicated Team: Suppose you have tight deadlines to configure all of the projects within it in that case you would need a specialist team of experts for handling all of the particular project specifications under time constraints. There comes the role of the dedicated team. They have endured with the best talents of experts and can prepare the whole roadmap for the clients.

The dedicated team setup with the relevant features as follows:

- Requirement gathering

- Assembling the team

- Integrating the team

- Talent selection

- Smooth working

Market Leaders

In the market of real estate, top loan lending app development companies are presently driven by global impact. Some of the leaders are as follows:

1. PaySense:

This app provides its users a quick method to apply for loans. If your loan plans are small and you want to take short-term loans for a few of your daily essentials or personal short-term plans, then use PaySense as your platform. They have quick services to offer their customers.

They have followed simple steps to sanctioned loans via KYC documents. Borrowers can choose from the EMI option and the loan granted within a few hours.

Read Also: Daily Deals App Development – Cost and Key Features

2. CASHe:

Another leading app that pays instant loans to borrowers after PaySense is CASHe that offers short-term goals. They have offered login via social media accounts with the security of two-way integration. For sanctioning the loan, your application needs to be verified by the lender, the payment will be processed within a few hours.

3. MoneyTap:

This app is dedicated to self-employed or are professionals and asking for instant money. Although you should be at the age above 23 years with the minimum salary of 20k per month, apply on this platform.

The process for getting quick money is simple. Borrowers have to fill a KYC document to complete their registration process. You can ask for the cash or the card payments, the amount will be credited to your account within some time. You can opt for the EMI options to pay the loan.

4. Kabbage:

Kabbage is another lending app for offering lending loans to users across the market. Either you are a professional or an individual, you can choose the relevant options to sanction your loans quickly. The maximum instant amount you can get access to is up to $100,000. You can get the history of all of the transactions within the app dashboard.

5. LazyPay:

This application is one of the tough competitions in the market. This is one of the easiest apps to process different loan sanctions each month.

If you want to be one of such market leaders, you need to sum up a few of the best-acquired features into the application. Let’s learn one by one what are the features needed to dwell inside the app.

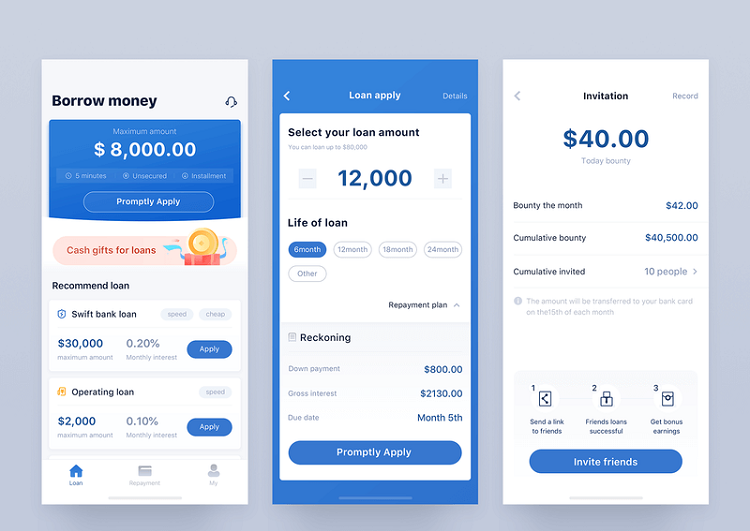

Features to add for developing the loan lending app

Loan Lending App Development is a crucial task for completing the mobile app. To develop the most intrinsic app consisting of several features, you must have to consider some of the important aspects while building the app. Choose wisely the standard pile of features to optimize the cost and quality of the process.

Some of the important features needed to focus on are below as follows:

For User:

- Connect with different bank accounts: This feature linked several bank accounts with each other to do in-app transactions.

- Registration with single app login or using social media: Users can easily sign up for the process by manually entering the details or using the social media login or using their Gmail account.

- Calculate their EMI and interest: This calculator helps to easily calculate the rate of interest and the EMI for easy installments.

- Payment scheduling and managing other documents: You can prepare and schedule the ongoing schedules using the calendar integration with the app and easily upload the document in the app.

- Secure payment support: With two-way authenticated support and security, users can easily make their payments. Some of the common payment options are UPI transactions, credit/debit cards, cash, e-wallets, and so on.

- In-app notification: This app prevails onsite notification related to deals or status to the user’s app.

- Geolocation: Turn on the GPS to get access to your location.

- Chat support: This is the must-have feature to give support to the users, in case of any issues you can consult with the executives.

For Lenders:

- Sign up: For any of the lenders, the signup process is a must-have feature.

- Profile management: Here in this section the lender can easily get accessed to different profiles of the different lenders and manage the information.

- Push notification: The lender gets easy alerts for the new requests from the user about the EMI payments.

- Account bank linking: Fast linking with the bank account to get faster loan transactions.

- Payment records: This section contains a list of all transactions made, anytime in the past.

- Lead management: All of the requests made by the users can be managed by the lenders.

For Admin:

There must be a significant assembly of configuration to the admin panel. Some of them are:

- Approved accounts: Admin has the full control to grant access to only genuine users and lenders, restricting the other ones from access.

- Management of the user accounts: This feature gives control to check and verify the user profile regarding the details, credit score, any loans in the past, etc.

- Management of the lender’s account: This section controls the activities performed by the lender, loan offered, and others.

- Reports and analytics: This section displayed the final report of any of the activities and prepared a report for that and approved/rejected any of the loans, earned commissions, number of the transaction, etc.

- Loan management: Admin manages this section to grant verified access and denies the unknown access to the dashboard, manages the loan transaction and other important activities.

- Rewards and offers: For every transaction, using this feature admin can offer to the users.

Advanced Features

To make your mobile loan lending app ready to leverage into the market, you must configure it with curative and advanced features.

- Loan calculator: This feature allows you to calculate the rate of loan interest and to estimate the time.

- CMS integration: This is the easy-to-manage configuration software for content.

- Cloud integration: To resolve the issue of storage, this feature allows to quickly render the storage issues and connect with the cloud and offers security as well.

- Automatic repayments option: Using this feature the EMI for the loan shall be deducted automatically.

- Multiple language support: This feature’s primary focus is to connect with different regions of people to target better reach.

Tech Stack

To prepare a successful app product, the app must consist of sleek UI, user interactive solutions, simple to use for the seamless journey of the user, lender, and the admin. The app must be loaded with soundproofed technology stack that are as follows:

- Frameworks: Lagom, Spring, Slick, Spring Boot, JSON, Play, Java8+, Akka

- App platforms: Android, iOS, React Native

- Web services: REST, SOAP

- Database: MongoDB, PostgreSQL

- Programming languages: JSON, Core Java

- Front-end technologies: JavaScript, Bootstrap, HTML5, CSS, React, jQuery

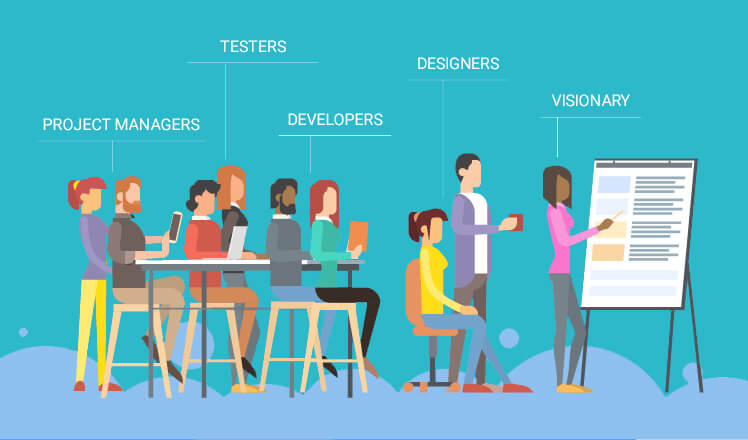

Required Team Structure for Loan Lending App Development:

Behind the success of any of the apps, there must be a team of experts who are capable of providing a thrilling experience to the end-users. Hire the best team of loan lending app developers for the intrinsic delivery of a qualitative app.

- Project manager

- Front end developer

- Back end developer

- Android developer

- iOS developer

- UI/UX designers

- QA specialist

- Business Analyst

Cost of Loan Lending App Development:

After getting the required development team and sufficient knowledge about the lending loan app now is the time to know about the cost requirement. Many parameters mutually decide the cost of any application. Some of the common factors are:

-

- App platform

- App design

- App features

- Team experience

- Time is taken to complete the project

- The geographic location from where they belong.

Although the price might differ from region to region, you can see below the variation in the prices according to the regions.

- USA: $60-$220 USD/ hour

- Europe: $50-$170 USD/ hour

- Singapore: $40-$160 USD/ hour

- Asia: $20-$60 USD/ hour

Hence, if we could estimate the cost for the basic mobile lending app it goes around $20,000-$40,000. However, the cost for the app with the usage of advanced features reached $30,000-$60,000.

Conclusion

Money lending mobile applications have gained popularity within a few years as compared to the formal way of granting the loans procedure. Time gradually passes and the new businesses have dug their hands into deploying mobile apps for the convenience of the people rather than go to the banks for sanctioning loans. Make sure that your app is exquisite with all of the essential features and is fully functional.

Start your own loan lending mobile app with Octal Info Solution to plan out relevant app development for you in no time! Let’s get a start, we are just a call away!